Chancellor comfy with recession if it brings down inflation

Jeremy Hunt has informed Sky News he’s comfy with Britain being plunged into recession if that is what it takes to deliver down inflation.

The chancellor mentioned that he would totally assist the Bank of England elevating rates of interest increased, doubtlessly in direction of 5.5%, because it battled higher-than-expected costs.

Asked by Sky News whether or not he was “comfortable with the Bank of England doing whatever it takes to bring down inflation, even if that potentially would precipitate a recession”, he mentioned: “Yes, because in the end, inflation is a source of instability.

“And if we need to have prosperity, to develop the economic system, to scale back the danger of recession, we have now to assist the Bank of England within the tough selections that they take.

“I have to do something else, which is to make sure the decisions that I take as chancellor, very difficult decisions, to balance the books so that the markets, the world can see that Britain is a country that pays its way – all these things mean that monetary policy at the Bank of England (and) fiscal policy by the chancellor are aligned.”

The feedback got here after market expectations for the eventual peak of UK rates of interest leapt dramatically, following higher-than-expected CPI inflation data this week.

While the anticipated peak for UK charges was just a little above 4.75% final week, it lurched increased, to five.5%, following Wednesday’s statistics. Save for the gyrations after the mini-budget final autumn, it was the largest shift in rate of interest expectations since 2008.

Prime Minister Rishi Sunak pledged in January that he would halve inflation this year, which in apply means bringing it down to only above 5% by the tip of 2023. The Bank of England’s forecasts earlier this week prompt he would narrowly succeed.

Read extra:

Grocery inflation eases for second consecutive month

Government borrowing sharply higher than expected

However, because the newest inflation knowledge is considerably increased than the Bank’s forecast trajectory, the pledge could also be missed.

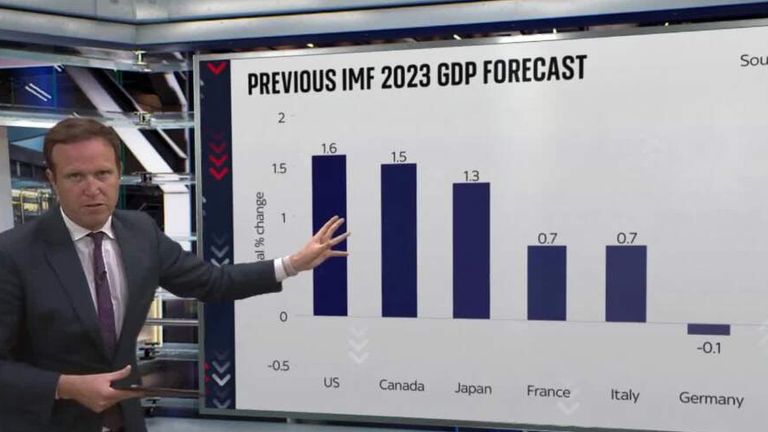

But the prime minister additionally pledged to develop the economic system. And whereas the International Monetary Fund mentioned this week that the UK would avoid recession, economists consider it is now believable, given these increased rate of interest expectations, that Britain as an alternative sees gross home product contract for 2 quarters – the technical definition of a recession.

Mr Hunt added: “When the prime minister announced that it was his objective to halve inflation in January, there were some people who derided that, they said: ‘well it’s automatic, inflation is going to come down anyhow’.

“There’s nothing automated about bringing down inflation, it’s a massive job, however we should ship it and we are going to.

“It is not a trade-off between tackling inflation and recession. In the end, the only path to sustainable growth is to bring down inflation.”