The large rate of interest rise: Who can be affected at this time – and the way a lot worse might it get?

The Bank of England’s rate of interest has elevated by 0.5 share factors – a determine that was greater than anticipated.

The 13th consecutive increase got here as a shock to most economists – however monetary markets had forecast, to a larger diploma, {that a} bolder transfer in opposition to inflation was warranted.

Here, Sky News explains the pondering behind the financial institution’s determination, and the rapid implications for your loved ones funds because the cost of living crisis continues to evolve.

Why is the financial institution mountain climbing so aggressively?

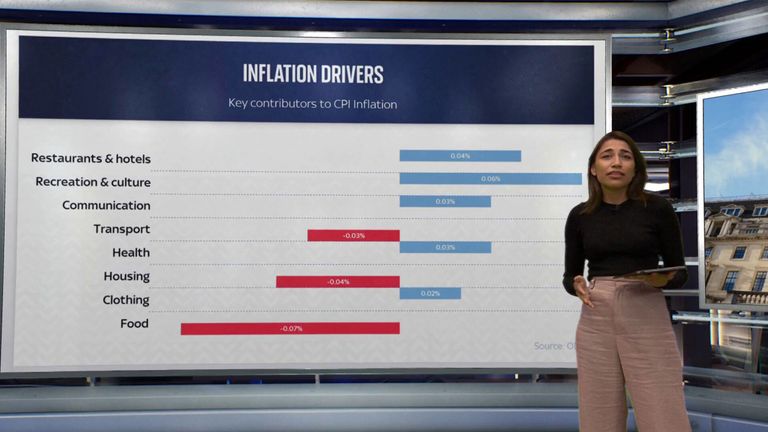

Put merely: the inflation quantity on Wednesday got here in so sizzling – remaining at 8.7% throughout May – that the financial institution felt it had no alternative however to behave extra aggressively.

The knowledge from the Office for National Statistics additionally confirmed that so-called core inflation, which strips out unstable parts similar to vitality and meals, was on the rise relatively than easing.

It’s a specific fear for the financial institution because it suggests value rises have gotten extra engrained within the economic system.

Governor Andrew Bailey has spoken out on “unsustainable” firm revenue margins and ranges of wage rises, at 7.2%.

But why impose extra hardship on me?

It is perverse, is not it, that in performing to finish the price of residing disaster as shortly as attainable, the financial institution is imposing much more prices on tens of millions of individuals.

Its solely device to utilise that is via a fee rise.

The financial institution, which has a 2% inflation goal, needs to see the annual fee of value progress stabilise round that degree – so its intention in making borrowing dearer is to curb demand within the economic system.

Who is affected at this time?

The dwindling variety of households on commonplace variable charges (SVR) or trackers – these which are linked to the Bank of England fee – will see their mortgage payments go up nearly immediately.

According to Moneyfactscompare, a fee rise of 0.5 share factors on the present common SVR of seven.52% would add roughly £1,576 onto whole repayments over two years.

Those on tracker offers, at a mean of virtually 5.5%, will see their month-to-month payments rise by simply over £47 per thirty days.

What about fixed-rate residential mortgage prospects?

There had been simply over two million households on SVR or trackers early final yr as financial institution fee began to creep additional up.

The bulk at the moment are on fixed-rate offers of both two or 5 years’ length – however these prices have been surging, too.

Because of rising market rate of interest expectations, funding prices for lenders have been going up within the course of, forcing banks and constructing societies to drag their greatest offers, generally inside days, and hold repricing.

That has been notably acute this month, with the common two-year repair simply passing 6% on Monday and hitting 6.19% on Thursday, based on Moneyfacts.

How are buy-to-let mortgages faring?

The majority of the 2 million such mortgages are on fixed-rate phrases.

Rising financial institution fee expectations, once more, solely locations extra prices on lenders.

They move them on to landlords who, in flip, make their tenants pay for it via their hire.

How a lot worse might this get?

Financial markets at the moment see UK financial institution fee hitting 6% early subsequent yr.

That is a complete share level greater than it stands at at this time.

By implication, it tells us that fixed-rate offers have additional to run above their present ranges.

Read extra:

The solution to bringing down inflation is a political nightmare for the Tories

Mortgage misery: What is causing the crunch, will it get worse and what can you do if you are struggling?

‘Eyewatering’ hit to 1.4 million, mainly young, mortgage customers ahead, IFS warns

Surely savers are benefiting?

Banks have been accused by shopper teams and MPs of being fast to move on fee hikes to their mortgage prospects however gradual to recognise the rises of their financial savings charges.

Building societies have had the higher press than banks typically.

Rachel Springall, finance knowledgeable at Moneyfactscompare.co.uk, stated of the present market: “A flurry of savings rate competition and consecutive Bank of England base rate rises continue to improve the savings market.

“Those savers incomes variable charges of curiosity who take time to evaluate their current pots might discover extra enticing returns can be found elsewhere, as their loyalty has not been rewarded.

“The top easy access accounts pay around 4%, with the market average around 2%, however, some of the biggest banks pay much less.”