Shipping diversions threat new wave in price of residing disaster

Behind virtually each buy you make, from Christmas lights to a brand new automotive, there’s a ship.

Almost the whole lot we purchase, use, put on, and far of what we eat, spends at the least a few of its life in a container at sea.

These big craft are the lifeblood of the worldwide economic system, circumnavigating the globe to satisfy client demand, transporting uncooked supplies from the US and Europe to Asia, and completed items within the different route, typically beginning within the mega ports of Shanghai and Singapore.

It’s additionally how oil and gasoline will get from the place it is sourced to the place it is wanted, be it crude from the Gulf or liquid pure gasoline from Australia.

Follow conflict newest:

British ship among those attacked

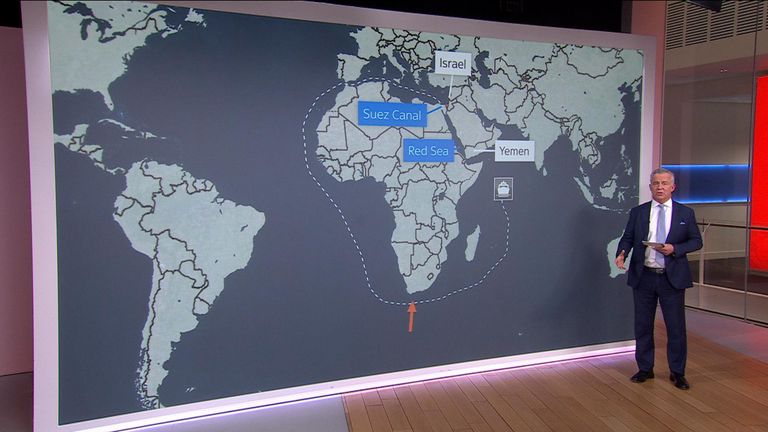

And round 10% of all that commerce passes by means of the Red Sea, the path to and from the Suez Canal, the essential artery that knocks as much as a fortnight off the journey from the Indian Ocean to the Mediterranean.

That is why the decisions by major shipping companies to cease sailing by means of the Red Sea, and BP’s resolution to ship its oil tankers the good distance spherical too, issues.

The cessation comes after weeks of assaults launched from Yemen, on the jap shore on the Red Sea’s narrowest level, the Bab al Mandab Strait.

Just 20 miles vast, it’s a pinch level from which militants have focused – what they declare – is freight sure to and from Israel.

They have been ready to do that regardless of the presence of American, British, French and different naval vessels within the Red Sea, partly to safe business transport.

The US and Royal Navy say they’ve intercepted rocket assaults over the weekend however that has not been sufficient to reassure firms, and crucially their insurers, that it’s secure to run the chance of the Red Sea.

The hazard from an financial standpoint is that we could also be firstly of a chronic interval of disruption.

German big Hapag-Lloyd instructed Sky News on Monday it won’t resume utilizing the Red Sea till the New Year on the earliest, and solely then when it’s assured that it’s secure.

Given the volatility of the area and the firepower obtainable to the Houthis that won’t be simple, and we could also be seeing the primary real financial contagion of the Gaza conflict.

From the second Hamas launched its assaults, there have been considerations {that a} wider regional battle could possibly be damaging, past the apparent human worth, however to this point that has not materialised.

The oil worth, for instance, has been largely steady regardless of essential Gulf actors having an curiosity within the area however which may now change.

Just a few days of disruption wouldn’t be disastrous to international provide chains however a number of weeks is one other matter.

The blocking of the Suez Canal by the grounded mega ship the Ever Given in March 2021 prompted chaos, and whereas international demand for transport is far decrease as we speak, nobody will welcome the inflationary strain of elevated transport prices.