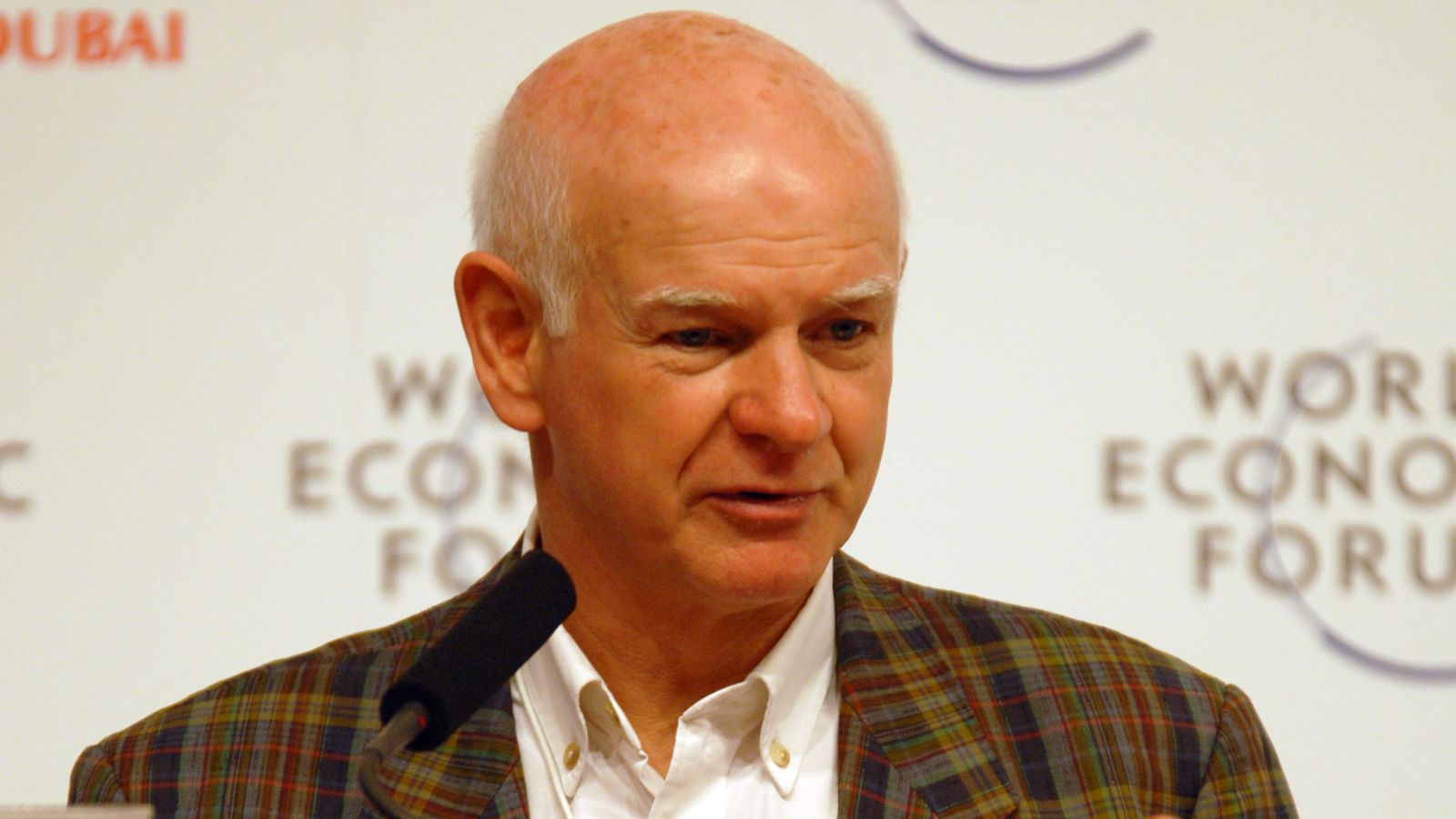

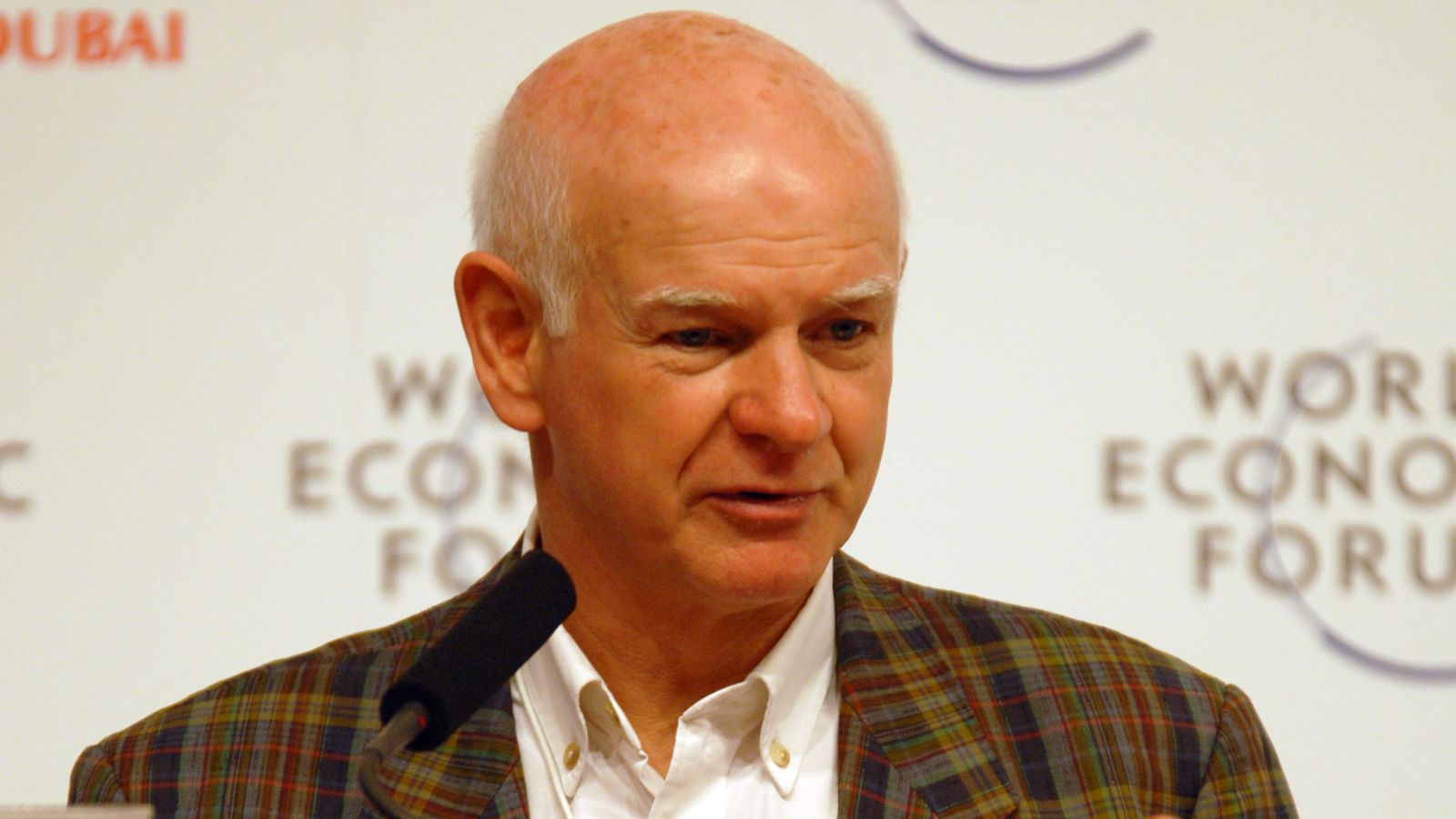

NatWest boss who earns £764,000 says not ‘that troublesome’ to purchase a home

The chairman of NatWest financial institution has come beneath fireplace after he claimed it isn’t “that difficult” for folks to get on the property ladder within the UK.

Sir Howard Davies, who’s paid £764,000 a yr based on the financial institution’s newest annual report, stated that whereas some discovered it exhausting to “start the process”, aspiring owners “have to save and that is the way it always used to be”.

He later responded to criticism, saying he “did not intend to underplay the serious challenges” folks face when shopping for a house.

It comes after latest analysis discovered dwelling possession in Britain fell from 71% to 65% between 2004 and 2021 amid hovering home costs.

Money blog: Calculate how your take-home pay is changing

Sir Howard, talking throughout an interview with BBC Radio 4’s Today programme, made the feedback after being requested when he thought it will change into simpler for folks to get on the property ladder.

He replied: “Well, I don’t think it’s that difficult at the moment… You have to save and that is the way it always used to be.”

The banking boss added: “What we saw in the financial crisis was the risk of having people being able to borrow 100% in order to get onto the property ladder, and then suffering severe falls in the equity value of their houses, and having to leave and having a bad credit record.

“So, there have been risks in very, very quick access to mortgage credit score.

“I totally recognise that there are people who are finding it very difficult to start the process, they will have to save more, but that is, I think, inherent in the change in the financial system as a result of the mistakes that were made in the last global financial crisis.”

Read extra from enterprise:

McDonald’s hit by Israel controversy

BARB ratings firm to be put up for sale

Interest rate hikes ‘net positive’ for economy

It got here as analysis from Halifax on Friday stated average property values increased by 1.7% in 2023, with the standard dwelling valued £4,800 larger than on the finish of 2022.

The financial institution additionally stated the typical value of a UK dwelling was £287,105 in December, with costs up 1.1% on the month earlier than.

Campaign group Generation Rent stated it was staggered by Sir Howard’s feedback.

Chief government Ben Twomey stated: “What planet does he live on? This is astounding to hear from a senior banker.

“We are in a cost-of-renting disaster that’s making it extremely exhausting for folks to purchase a house as we hand a 3rd of our wages each month over to our landlord.”

He added: “Interest charges have elevated however home costs have but to appropriate, which means we nonetheless want to save lots of for an enormous deposit, but in addition would wish a excessive earnings to afford month-to-month mortgage repayments.”

Nigel Farage, who was embroiled in a row with NatWest last year over his Coutts checking account, was additionally vital of the feedback.

He informed GB News: “It is all however inconceivable for younger folks to get on the property ladder, and what that has accomplished is it has destroyed the tradition of thrift.

“Howard said save, but I have spoken to young people who have said that there is no point saving because we are never going to save enough to even get the deposit that is now required.”

Bank boss ‘didn’t intend to underplay challenges’

Nathan Emerson, chief government at property agent physique Propertymark, stated: “Saving for a home can be a real struggle for many first-time buyers and can make purchasing a home feel like an impossibility.”

He added: “House prices have started to drop from the spike seen on the back of the pandemic, so for some, this should be seen as a golden opportunity. Of course, more needs to be done to help first-time buyers”.

The feedback additionally prompted a backlash on social media.

Finance skilled Prof Richard Murphy, from Sheffield University, wrote on X that Sir Howard’s remarks had been a “staggering demonstration of the disconnect between bankers and reality in this country”.

Following the backlash, Sir Howard issued an announcement afterward Friday, “clarifying” his feedback.

He stated: “Given recent rate movements by lenders there are some early green shoots in mortgage pricing and while funding remains strong, my comment was meant to reflect that in this context access to mortgages is less difficult than it has been.

“I absolutely realise it didn’t come throughout in that means for listeners and as I stated on the programme, I do recognise how troublesome it’s for folks shopping for a house and I didn’t intend to underplay the intense challenges they face.”

“People have to save lots of rather more than they did up to now and that’s robust for first-time consumers.”