How Budget 2024 had a smaller affect on public funds than the autumn assertion

Perhaps essentially the most telling factor to say about this price range is that it was simply… slightly bit skinny.

Indeed, when it comes to its affect on the general public funds, it was considerably smaller than the autumn assertion.

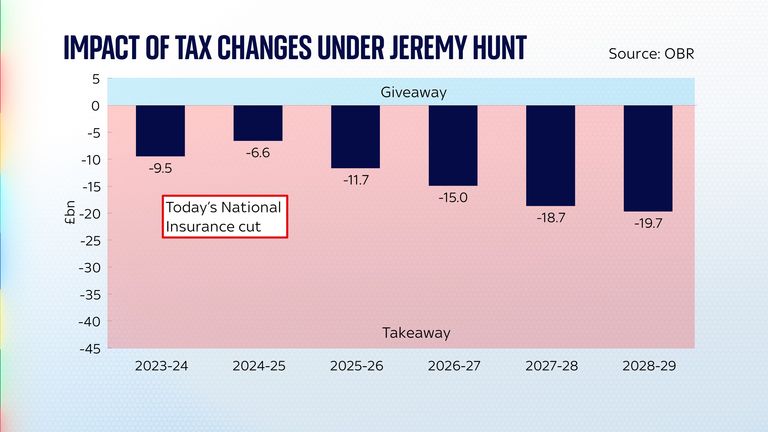

Back in November, the chancellor delivered £20bn value of tax cuts, roughly break up between the 2p reduce to nationwide insurance coverage and the introduction of “full expensing” on enterprise funding.

Today’s budget was basically half the scale of the autumn assertion, amounting to round £10bn of tax cuts – basically an additional nationwide insurance coverage reduce and some different bits and items.

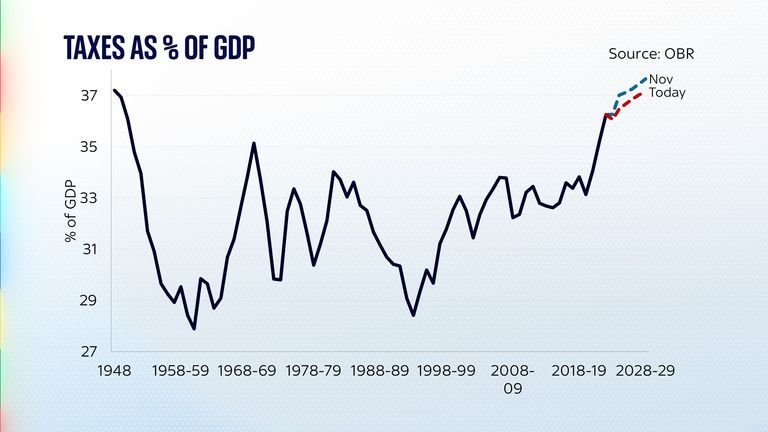

The chancellor spent a lot of his speech calling this a “tax-cutting budget”, however this isn’t totally correct.

It’s actually true that following the national insurance cut, total ranges of taxation within the UK won’t rise as quick as they have been anticipated to 6 months in the past.

But they may nonetheless rise.

The essential cause for that’s that the federal government has frozen the brink at which individuals start to pay taxes, and pay the upper charges of taxes.

The upshot is that as you earn extra (and with inflation so high, earnings are also going up shortly), you pay significantly extra tax.

And whereas the cumulative 4p reduce in nationwide insurance coverage (2p in November, 2p immediately) will assist scale back the ache, it will not fully compensate for it.

Consider: the affect of fiscal drag on the typical family is roughly £1,500. Following the cuts in nationwide insurance coverage, that internet “takeaway” will drop to about £700. It’s nonetheless in detrimental territory; individuals will nonetheless be paying extra tax. But it is much less of a tax rise than earlier than.

Read extra:

How very inaccurate forecasts determine the amount spent on investment or tax cuts in budget

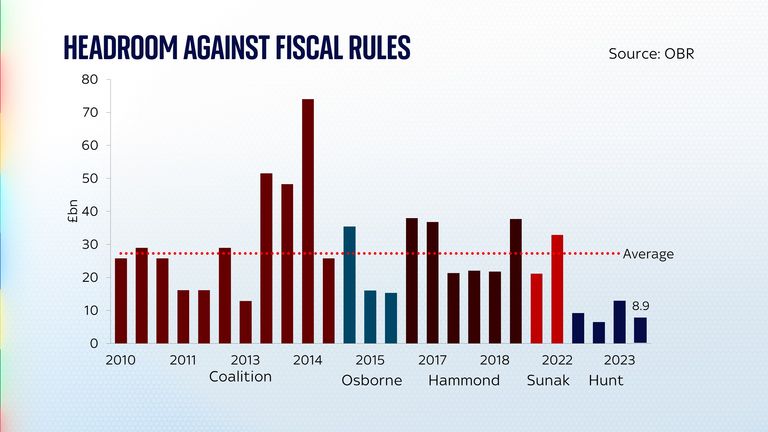

Why the dearth of ambition? In massive half as a result of the chancellor seems to be decided to stay to his fiscal rules, and people fiscal guidelines give him solely a sliver of room to spend more money.

Back on the time of the autumn assertion, the Office for Budget Responsibility put that quantity of “headroom” at £13bn.

In the intervening interval, the general public funds really deteriorated barely, with the upshot that earlier than the chancellor started to chop taxes at this price range, his headroom had dropped slightly bit, to £12.2bn. So he merely did not have a lot room to spare.

In the occasion, he used up a bit of that headroom, leaving him with £8.9bn.

One lesson is that if the numbers do not change and if Jeremy Hunt stays decided to not bend or break his fiscal guidelines, he will not have a lot cash left to spend forward of the election.

Some good news

Whether individuals are impressed by the chancellor’s rigidity on these guidelines stays to be seen. But there was a minimum of some higher news on the broader state of the economic system from the OBR’s financial forecasts.

The official forecaster upgraded its projection for actual family disposable earnings this yr and subsequent – suggesting the ache of the price of dwelling disaster is lastly abating.

There is even an opportunity of the feelgood issue returning to the economic system, particularly if the Bank of England begins reducing rates of interest quickly.

Click to subscribe to the Sky News Daily wherever you get your podcasts

The query for the Conservative Party is whether or not that feelgood issue is mirrored within the polls.

Either method, this fiscal occasion felt considerably underwhelming. Not an enormous bang, however a quiet continuation of the insurance policies the chancellor has been proposing for a while.

That, presumably, is the plan. Whether it’s going to repay is one other query.