Monese founder to purchase client arm in break-up

An HSBC-backed expertise firm which was in talks to boost funding at a valuation of over £1bn 4 years in the past will this week affirm a plan to interrupt itself up amid mounting losses.

Sky News has learnt that Norris Koppel, the founder and chief govt of Monese, is to take management of its client arm as a standalone entity.

Tera Ventures, an Estonian enterprise capital agency, is claimed to be backing the plan.

Its business-to-business arm, XYB, in the meantime, might be hived off and run as a separate entity by a brand new boss, in response to folks near the corporate.

Monese’s board was understood to be finalising the plans on Monday night, with an announcement anticipated on Tuesday, they added.

The break-up plans had been reported by Sky News earlier this month.

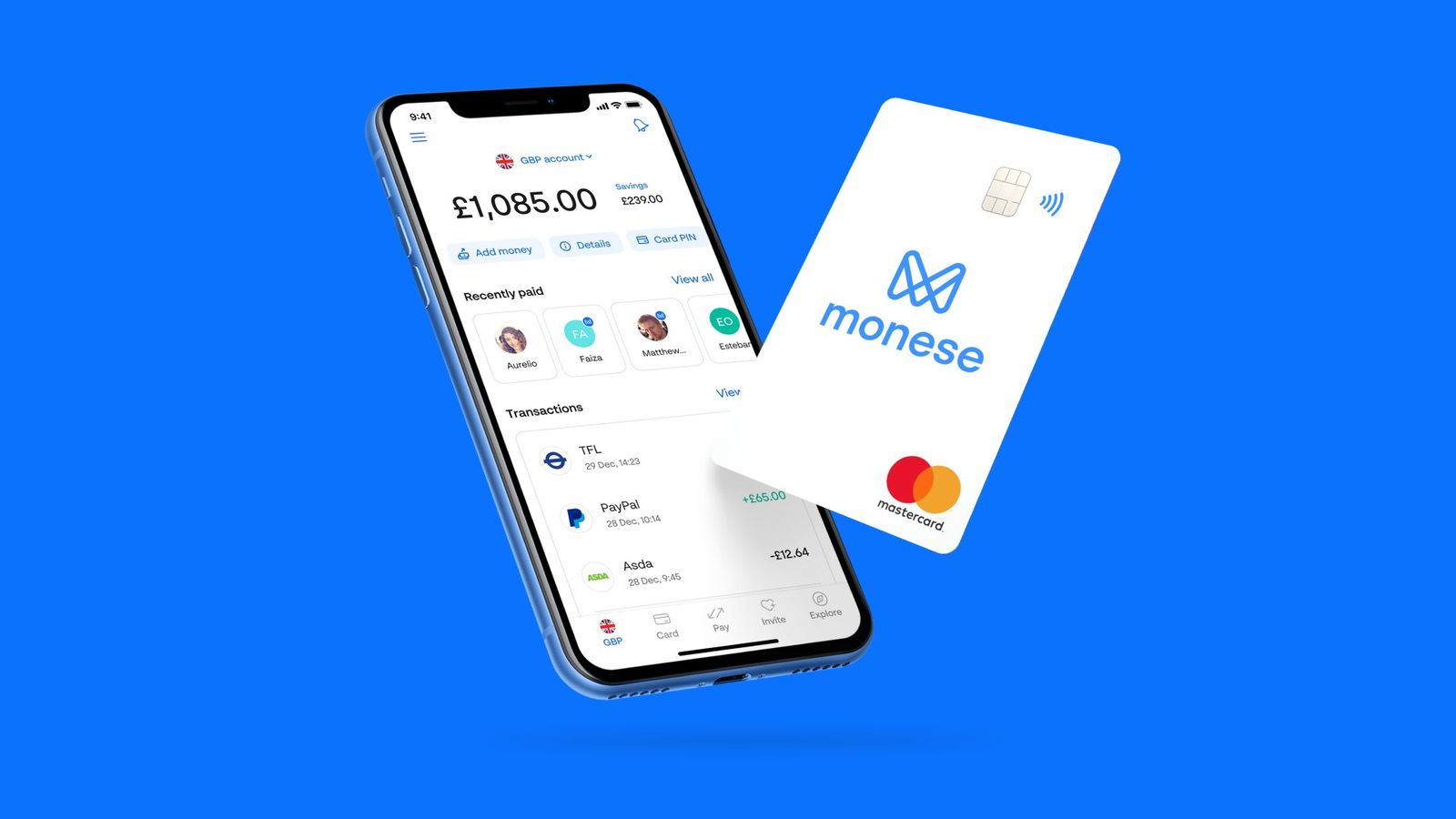

Monese targets prospects who’re underserved by mainstream banks, and has about 2 million prospects in additional than 30 nations.

It employs roughly 275 folks.

The fintech has come underneath strain from some buyers to interrupt itself up.

HSBC, the London-based banking behemoth, invested $35m in Monese in 2022 in alternate for a stake within the firm.

A Monese spokesman mentioned earlier this month: “The business has developed in two different directions: the original B2C business and now the new and fast-growing B2B PaaS (Platform as a Service) business.

“We are exploring one of the best organisational and capital construction for the corporate must be to maximise shareholder worth.”

In accounts filed earlier this year, Monese referred to “materials uncertainty over the success of elevating future fundraising and due to this fact the going concern standing of the corporate”.

Its other shareholders include Investec and Augmentum, the London-listed fintech investor.

At the time of its deal with HSBC, it said it had raised a total of more than $200m.

A source close to the company insisted that it had begun 2024 on a strong footing following robust performance last year.

They said Monese had seen continued revenue growth and losses reducing from £30.5m in 2022 to low single-digit millions.

“The firm is approaching profitability within the close to time period,” they added.

Monese and Interpath Advisory, which has been engaged on the restructuring, each declined to remark.