Annual mortgage repayments set to rise by £2,900 on common subsequent 12 months, says assume tank

Annual mortgage repayments are set to rise by £2,900 for the common family remortgaging subsequent 12 months, in response to a assume tank.

As the UK’s “mortgage crunch” deepens, whole annual mortgage repayments may rise by £15.8bn by 2026, the Resolution Foundation stated.

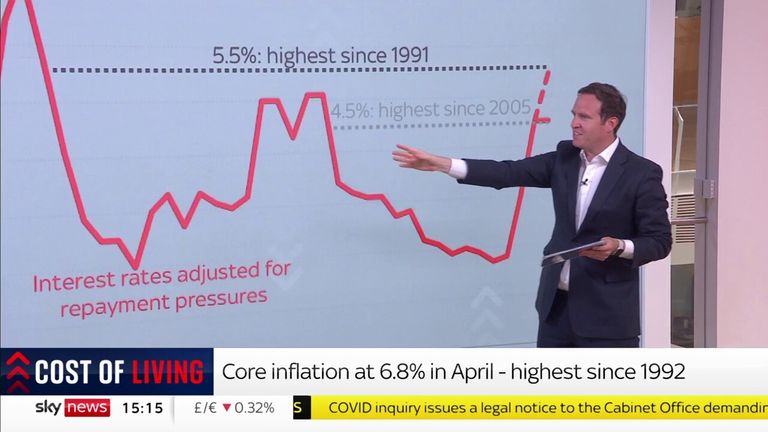

Prolonged inflation has raised expectations that the Bank of England’s base rate-rising cycle, which began in December 2021, will proceed for longer than initially thought.

Rates at the moment are anticipated to peak, in mid-2024, at practically 6%, the inspiration stated.

Those larger expectations are shifting by means of into mortgage charges, with offers being withdrawn from the market and being changed by larger charges.

Data launched by Moneyfactscompare.co.uk indicated that the common two-year fixed-rate house owner mortgage was slightly below the 6% mark, at 5.98%.

The Resolution Foundation stated it’s anticipated that the common two-year fixed-rate mortgage is not going to fall beneath 4.5% till the top of 2027.

This would considerably enhance the dimensions of the mortgage crunch presently unfolding, it stated.

Annual repayments at the moment are on observe to be £15.8bn a 12 months larger by 2026 up from a projected £12bn enhance on the time of the latest Monetary Policy Report in early May, the inspiration stated.

Around three-fifths of this enhance in annual mortgage funds is but to be handed on to households, as debtors transfer off present fixed-rate mortgage offers on to new fixed-rates, as much as 2026, the report added.

This is anticipated to ship a rolling dwelling requirements hit to tens of millions of households within the run-in to the following normal election.

This 12 months’s price rises are additionally predicted by the inspiration to extend the price of a typical mortgage by 3% of typical family earnings this 12 months – even greater than a 2.4% enhance seen in 1989.

Read extra:

Mortgage payers face largest home loan squeeze since early 1990s housing crash

More mortgage costs rise with ‘worse to come’

Bank boss ‘trying to limit the pain’ as mortgage rates continue to rise

The basis, which focuses on bettering dwelling requirements for these on low to center incomes, stated that the higher news for the federal government, nonetheless, is that the present mortgage crunch is much less widespread than earlier shocks.

Back in 1989, practically 40% of households owned a house with a mortgage, and had been subsequently uncovered to rising prices.

By final 12 months, the mixture of extra older individuals proudly owning outright, and fewer younger individuals proudly owning properties in any respect, meant that the share of households with mortgages had fallen beneath 30%.

Overall, round 7.5 million households with a mortgage are anticipated to see their repayments rise by 2026, the report stated.

Simon Pittaway, senior economist on the Resolution Foundation, stated: “Market expectations that interest rates are going to rise even higher, and stay higher for longer, are having a major effect on the mortgage market, with deals being pulled and replaced with new higher-rate mortgages.

“This means the mortgage crunch is now on observe to extend mortgage payments by £15.8bn, with these re-mortgaging subsequent 12 months set to see their prices rise by £2,900 on common.”

A Treasury spokesperson said: “We know it is a regarding time for mortgage holders, which is why the FCA (Financial Conduct Authority) requires lenders to supply tailor-made assist to debtors struggling to make their funds, and we proceed to assist mortgage holders by means of the Support for Mortgage Interest scheme.”