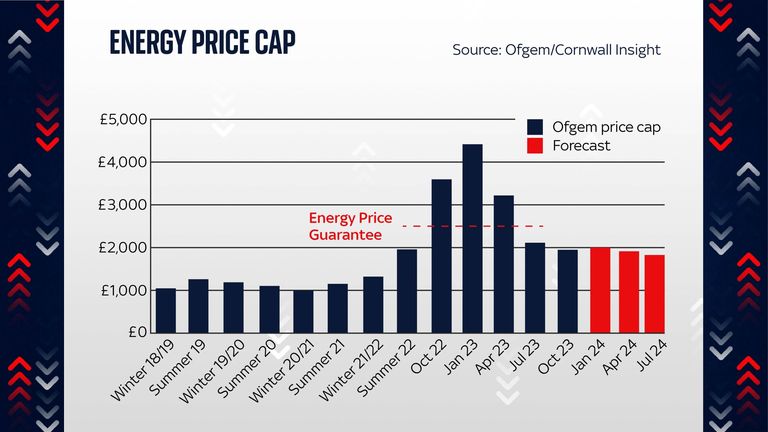

Common vitality invoice to fall beneath £2,000 for first time since early 2022

The vitality regulator has confirmed a minimize to its value cap that may see common family payments come down this autumn, as specialists proceed to warn of hikes to return in the course of the winter months.

Ofgem mentioned the standard family paying by direct debit for fuel and electrical energy faces an annual cost of £1,923 from October to December.

That was down from the £2,074 degree set for the three months to the top of September, bringing some additional reduction to customers nonetheless grappling with the consequences of the energy-driven cost of living crisis.

The value a provider can cost for fuel is falling from 6.9p to six.89p per kilowatt hour (kWh) – with the price of electrical energy dropping from 30.1p per kWh to 27.35p.

The discount is essentially defined by weaker wholesale costs.

The value cap would have been decrease nonetheless, by an additional £100, if it had mirrored a looming Ofgem calculation that offers a nod to diminished vitality use.

Ofgem chief govt Jonathan Brearley mentioned: “It is welcome news that the price cap continues to fall, however, we know people are struggling with the wider cost of living challenges and I can’t offer any certainty that things will ease this winter.”

Household consumption has fallen sharply following the invoice shocks of the previous 18 months.

However, there are warnings from industry forecasts that peak winter will probably see payments rise again above the £2,000 mark.

Energy Security Secretary Grant Shapps described October’s fall as “encouraging” – and claimed it was one other milestone within the authorities’s promise to halve inflation.

“We are successfully driving Putin out of global energy markets so he can never again hold us to ransom, and we are boosting our energy independence to deliver cheaper, cleaner and more secure energy to British homes,” he added.

But Labour’s shadow vitality and internet zero secretary, Ed Miliband, claimed the most recent value cap announcement “demonstrates the scandalous Tory cost of living crisis is still raging for millions of people”.

He claimed the federal government was siding with oil and fuel firms making file income, including: “Higher energy bills are unfortunately here to stay under the Conservatives, even with this fall, bills are significantly higher than they were only three years ago.”

Read extra:

Cost of living latest – as supermarket cuts prices

Meanwhile, a thinktank has declared thousands and thousands of the poorest households will pay more regardless of the value cap minimize.

The Resolution Foundation blamed the withdrawal of vitality help schemes and an increase in prices added to payments.

The value cap units a restrict on the quantity suppliers can cost for every unit of fuel and electrical energy used and for the privilege of being linked to the vitality community. The extra you utilize, the extra you pay.

Even on the diminished cap mark, it stays about £800 above 2019 ranges at a time when households are coping with excessive inflation and better housing prices – largely as a consequence of rate of interest rises by the Bank of England supposed to boring the tempo of value rises within the financial system.