Mounted mortgage charges largely unchanged regardless of shock curiosity rise

Average fastened mortgage charges are largely unchanged following the Bank of England’s shock announcement of a 5% base rate of interest, in response to a monetary info firm.

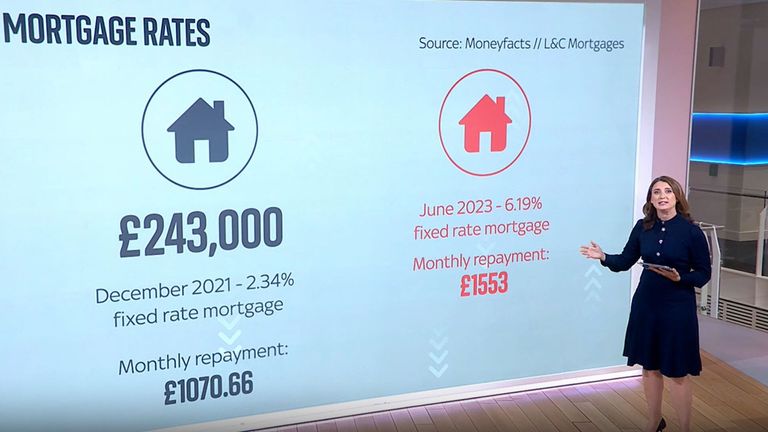

There has been no change to the typical mortgage price for a two-year fastened deal, Moneyfacts information confirmed. The price has remained at 6.19%, the identical because the day earlier than.

Only a small enhance was recorded for a 5 12 months fastened deal – the figures confirmed the typical price crept from 5.82% on Thursday to five.83% on Friday.

The rising average rates seen by means of June and late May could clarify why no dramatic will increase got here on Friday.

Lenders had been pricing in anticipated price rises to their providing as inflation proved stubborn, including strain on the Bank of England to do extra to carry worth rises down by means of growing rates of interest.

Moneyfacts stated it had one of many largest day by day rises within the common two 12 months fastened mortgage price in June because the begin of 2023.

Overall the charges are nonetheless a marked enhance from the years of extremely low rates of interest. Less than two years in the past, in October 2021, the typical price on a 5 12 months deal was 2.55%.

“The average two-year fixed rate has seen several notable daily uplifts in June, compared to the rest of 2023, so it is possible there may be a bit more stability surrounding price hikes moving forward over the next few days,” Rachel Springall of Moneyfacts stated.

A fall within the variety of mortgages available on the market was recorded by Moneyfacts however the lower was comparatively small.

On Friday there have been 4,444 mortgages on supply, in comparison with 4,507 on Thursday. It continues to be greater than had been on supply earlier than the Liz Truss authorities’s September mini-budget.

The majority of mortgage holders are on fastened price offers, more likely to be impacted by the Bank of England’s latest “shock” interest rate rise, which introduced the bottom rate of interest to five%.

More than 2.4 million fixed-rate offers will expire from now to the top of 2024, UK Finance, the banking business commerce physique, stated.

It comes as Chancellor Jeremy Hunt met mortgage lenders on Friday to see what assist they’ll supply these in arrears and folks scuffling with costlier mortgages.

The assembly contained “good working level discussions” in response to Charlie Nunn, Lloyd’s chief govt.