Largest public sector wage progress since 2003 whereas jobless price ticks up

Public sector wage settlements are at their highest ranges since 2003, in accordance with official employment figures that additionally present a pick-up within the jobless price.

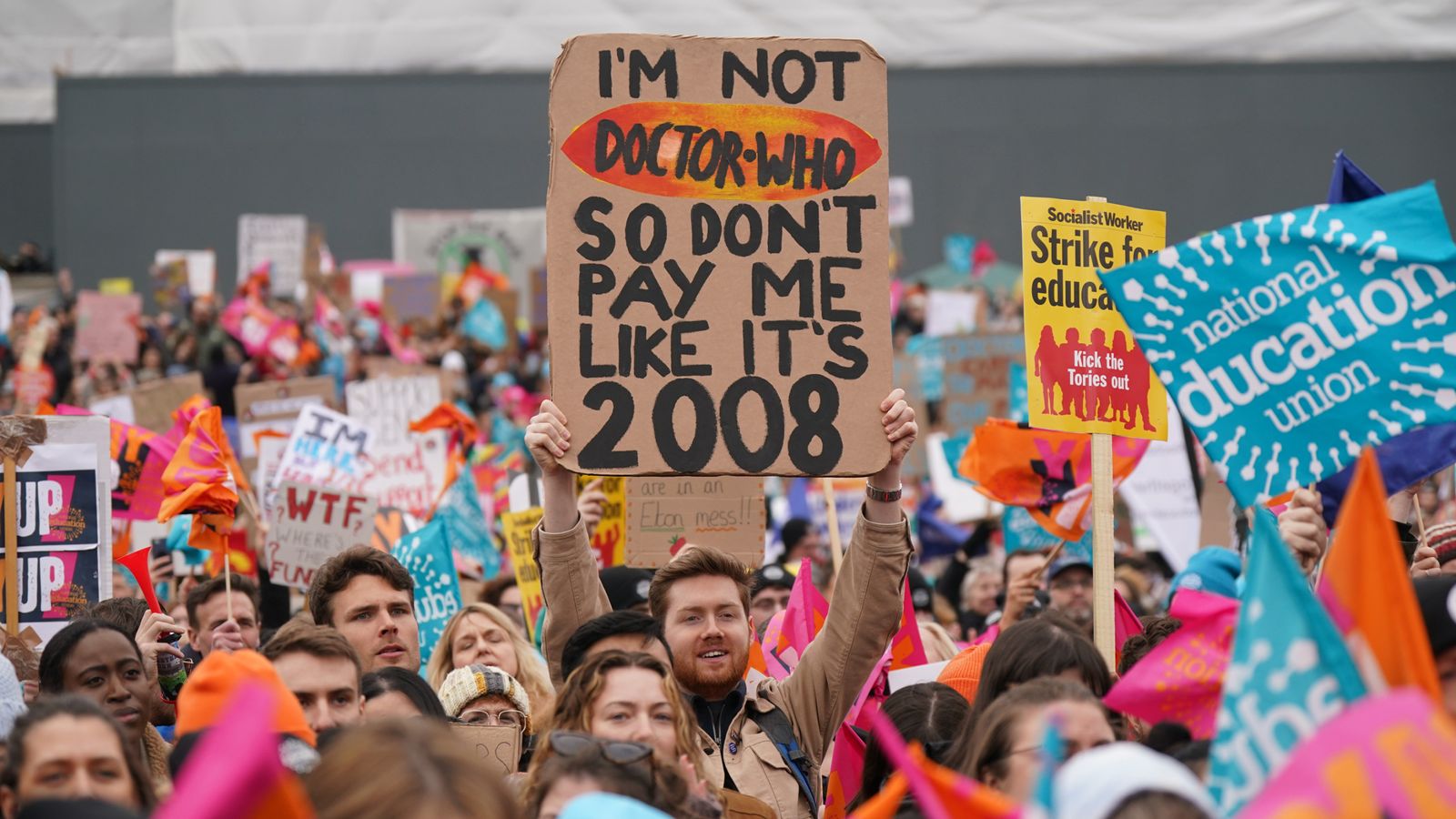

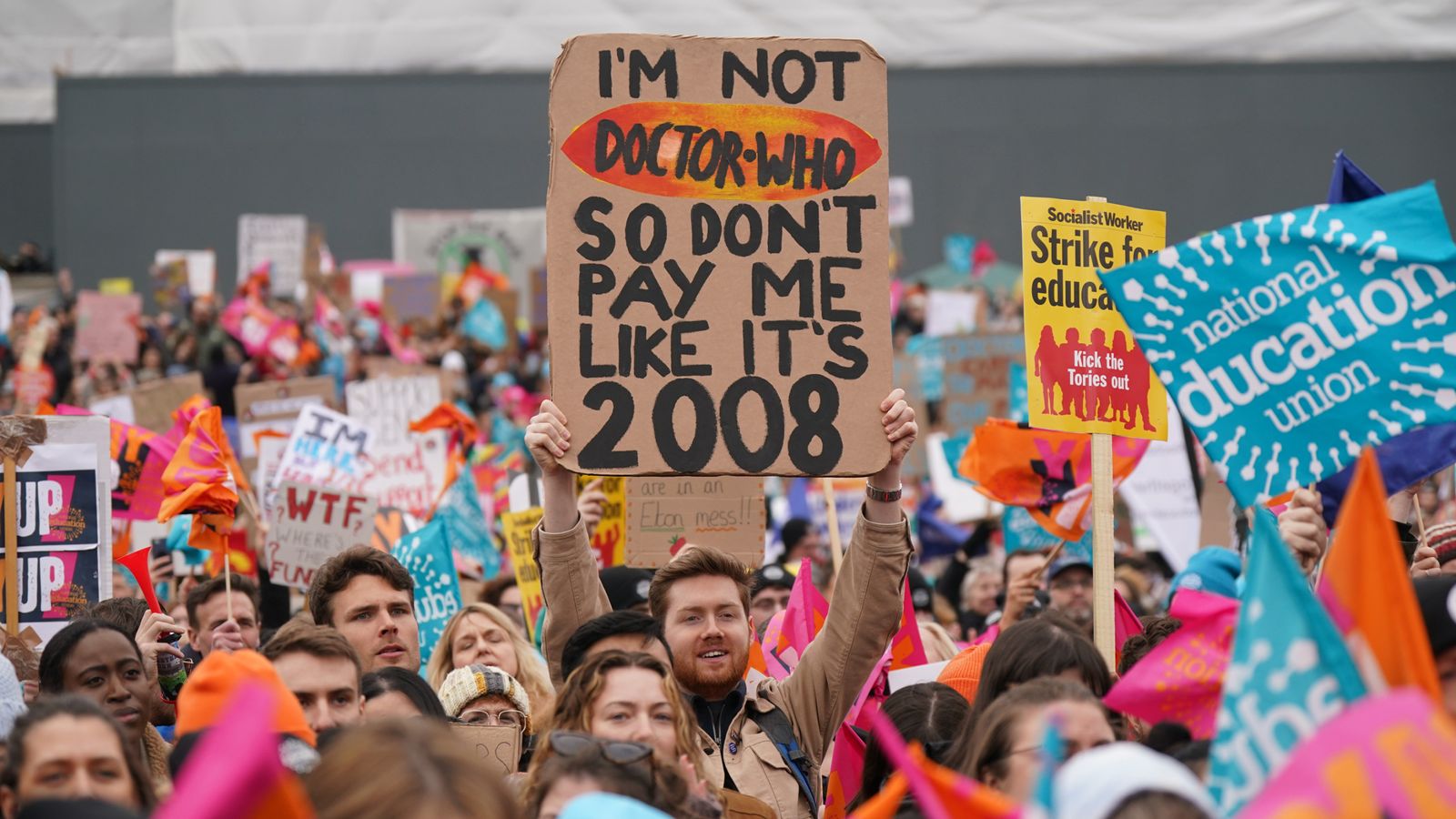

Data from the Office for National Statistics (ONS) confirmed common common pay progress within the public sector of 5.6% between January and March – a time when strikes hit a number of key providers together with the NHS and faculties amid the cost of living crisis.

There have been 556,000 working days misplaced due to labour disputes in March, the report stated.

Cost of living latest: Pensioners have just days to claim £301

That was up from 332,000 in February and took the overall for the yr to this point to 1.1 million.

Private sector wage progress was at 7% over the identical January-March interval.

The wider ONS figures calculated wages, excluding the results of bonus funds, rising at an annual price of 6.7% within the yr to March.

That was up from the 6.6% determine reported the earlier month.

Average weekly earnings have been, nonetheless, barely down at 5.8%.

A serious concern for the federal government would be the persevering with pattern of long-term illness.

The ONS stated 2.55 million folks have been now out of labor for that purpose, a brand new report excessive.

The determine represents greater than 8% of the workforce.

In additional indicators of a deteriorating jobs market, vacancies additionally fell – for the tenth month in a row – to 1.08 million.

The unemployment price stood at 3.9% – up from 3.8% – regardless of a surge in employment because the variety of self-employed grew and extra folks took part-time work.

The enhance in unemployment, the ONS defined, was largely pushed by folks unemployed for over 12 months.

Darren Morgan, its director of financial statistics, stated: “Employment and unemployment both rose again in the first three months of 2023, driven in particular by men.

“This means the variety of these neither working nor searching for work continues to fall, though the variety of folks not working on account of long-term illness rose once more, to a brand new report.

Read extra from enterprise:

One in five taxpayers face 40% rate by 2027 – with these professions hard hit

Investigation into whether shoppers being overcharged for food and fuel

“Despite continued growth in pay, people’s average earnings are still being outstripped by rising prices,” he famous.

The wage figures, together with core inflation information, are key indicators for the Bank’s rate-setting committee.

Members will need to see proof that each are cooling earlier than taking their toes off the speed hike pedal.

Governor Andrew Bailey stated final week, after the Bank imposed its 12th consecutive rate hike to 4.5%, that inflation could be increased this yr than it had earlier anticipated.

It blamed the upwards stress on meals – one thing that’s outdoors its management however which can be mirrored within the inflation figures over the months forward.

The subsequent set of inflation information protecting the yr to April will, nonetheless, present the primary main easing within the headline shopper costs index (CPI) quantity for the reason that infancy of the price of dwelling disaster.

That is as a result of the results of the primary main surge in power payments in April 2022 is ready to fall out of the calculations.

Economists see CPI easing from its present price of 10.4% to round 8% when April’s determine is revealed subsequent week.