‘Dangerous’ for presidency to intervene as mortgage prices surge, ex-Bank of England deputy warns

It could be “risky” for the federal government to guard mortgage holders towards rising rates of interest, in response to a former Bank of England deputy governor.

Speaking to Sophy Ridge on Sky News, Sir Charlie Bean stated making an attempt to assist these paying off dwelling loans might drive the financial institution to lift the bottom fee even additional.

His warning follows a report from the Resolution Foundation think tank that claims common annual mortgage repayments are set to rise by £2,900 for these renewing subsequent 12 months.

Total annual mortgage repayments might rise by £15.8bn by 2026, the report added.

Politics live: Cabinet minister reacts to ‘indefensible’ lockdown party video

Sir Charlie stated: “There’s not a lot [government] can do to influence the overall macro environment in a favourable way.

“There could also be issues it desires to do to alleviate ache on specific elements of the inhabitants, poor households or no matter.

“There obviously have been some calls for protecting those with mortgages.

“I believe that is dangerous territory to get into due to course, in case you try this and scale back the pressures on these with mortgages, that reduces the extent to which the financial system slows and simply means the financial institution has to lift interest rates much more.”

An prolonged interval of inflation led the Bank of England to lift rates of interest, pushing up the price of borrowing.

These will increase at the moment are anticipated to proceed till the center of subsequent 12 months, with the bottom fee forecast to peak at almost 6%.

Read extra:

Explained: What is causing the mortgage crunch

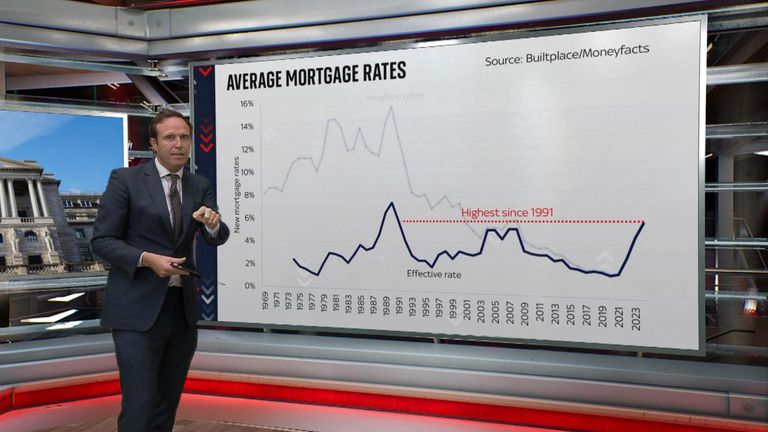

Ed Conway: Mortgage payers face largest home loan squeeze since early 90s

Sunak insists he won’t pass the buck if he misses key inflation pledge

With an election anticipated in 2024, rates of interest persevering with to rise forward of the vote would trigger complications for Rishi Sunak and campaigners for the Conservative Party.

The uncertainty has led to TSB pulling all its 10-year fixed-rate offers from the market – and Santander withdrew its provides for brand spanking new debtors this week.

Michael Gove, the housing secretary, was requested by Sophy Ridge whether or not he was “frightened” by the scenario.

He stated he was “concerned of course”, saying the federal government’s goal of getting inflation down would permit the financial institution to cut back rates of interest.

The cupboard minister revealed he doesn’t have a mortgage, however acknowledged the scenario is “very difficult for hundreds of thousands of people”.

He added: “As a minister who is responsible for housing, I do take a close interest in what’s happening in the mortgage market.

“It solely reinforces the significance of doing every thing else that we will to help householders and certainly, particularly, to assist these within the rental sector as effectively who’ve confronted the prospect of accelerating rents and that is why we’re bringing ahead laws, the Private Rented Sector Reform Bill, with a purpose to assist them.”

The invoice is aimed at removing no-fault evictions and holding landlords to increased requirements, whereas additionally permitting householders to have a better time recovering properties from disruptive tenants.

Criticisms have been made of the Bank of England for not elevating rates of interest quick sufficient, permitting inflation to rise.

Sir Charlie admitted that his outdated employer was “a little behind the curve” in its actions – however added many of the inflationary strain was coming from exterior elements like “the war in Ukraine, rising gas prices, global food prices, also supply chain pressures as economies reopened after the pandemic”.