Black Friday tricks to keep secure and keep away from scams whereas purchasing on-line

The risk of fraud and cyber scams is a 365-days-a-year drawback relating to on-line purchasing.

But simply as the speed at which retailers hit you with promo emails scales up at the moment of yr, so too does the chance of falling foul of criminals making an attempt to entry your checking account.

According to the National Cyber Security Centre (NCSC), buyers misplaced greater than £10m to cyber criminals over final yr’s festive purchasing interval.

With Black Friday gross sales below method and Christmas on the horizon, Sky News enlisted some cybersecurity specialists to supply recommendation on how greatest to remain secure and keep away from scams this yr.

Spotting a dodgy electronic mail

A favorite tactic of fraudsters is to attract you in with an electronic mail that appears remarkably professional, seemingly providing an unique deal at certainly one of your favoured retailers.

It is, as Mike McLellan of Secureworks places it, a “classic scenario we’d expect to see around Black Friday”.

An necessary factor to look out for is the area identify of the sender’s electronic mail tackle – is it a detailed match, however with one thing barely off? Think @amaz0n.co.uk, for instance.

“On smartphones, that kind of detail is usually hidden,” advises Mr McLellan. “So tap on it and check where the email has come from.”

You also needs to hold a watch out for misspellings and odd formatting.

However, the NCSC has warned that criminals are doubtless to make use of more and more accessible AI instruments to provide much more convincing rip-off emails, web sites, and adverts than common.

If you are in any respect not sure, it is good apply to go to the web site immediately, moderately than click on on any hyperlinks within the electronic mail.

Fake web sites

Some scams might direct you to a retailer’s login web page to enter your account data.

It may look completely regular, and also you go forward and pop in your username and password, whereas within the background, criminals seize that data and use it themselves.

Chris Bluvshtein, of VPNOverview, says: “Every website should have a valid security certificate, and you can tell by the little padlock icon next to the URL.

“If a web site would not have certainly one of these, then do not give your financial institution particulars or helpful data.”

These can be some of the hardest scams to notice yourself, but banks have become very good at alerting you to “uncommon logins” and flagging any subsequent dodgy transactions.

“If you observed one thing unhealthy has occurred, take into account altering your password,” Mr McLellan says. “And checking your financial institution exercise.”

Text message scams

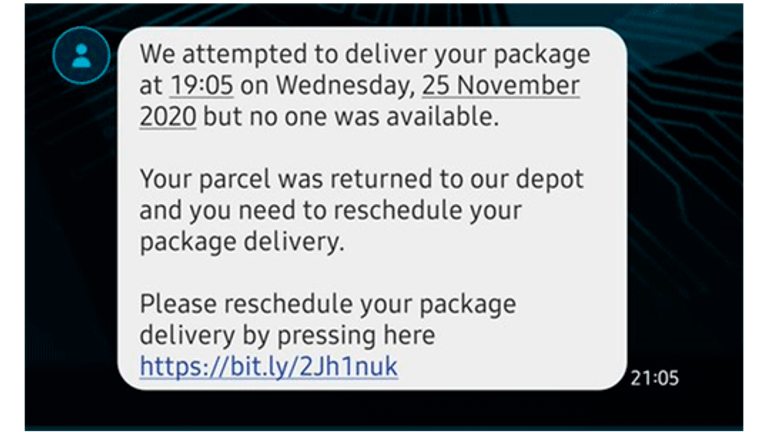

Another classic of the Black Friday scam genre is a text message suggesting you have a parcel waiting with DHL, Royal Mail, or some other delivery provider.

“Quite usually you’ll be anticipating one thing whenever you get these texts – however once more hold a watch out for something that does not look regular,” says Mr McLellan.

A good indicator that something is amiss is if the text asks you for payment and includes a bit.ly link.

You should not click on these.

The rise of ‘Qishing’

An rising risk over the previous yr is an extension of phishing utilizing QR codes.

Secureworks has dubbed it “Qishing”, when criminals use them to direct unsuspecting customers to fraudulent web sites that would steal their private data.

Director of risk intelligence, Rafe Pilling, says: “We’re so used to seeing ‘scan this code’ to register, view a menu, order drinks or food to a table, or even enter competitions via the big screen at events stadiums, that consumers are thinking less about what they’re actually scanning.

“As the hype round holidays like Black Friday drives extra urgency in shopper actions, we are able to anticipate to see extra cyber criminals taking benefit with Qishing.”

Password managers and mobile payments

Modern smartphones and web browsers offer some useful baked-in features to help you stay safe.

Both have password managers and generators, which will come up with randomised options for you to lock your accounts and then store those behind a master password – or even biometrics like facial or fingerprint recognition.

Consider multifactor authentication as well, says Mr McLellan, for an extra layer of security.

Apple and Google Pay are good payment options if the retailer accepts them, as they protect your bank details.

“It’s greatest to make use of them as a substitute of your debit card,” says Mr Bluvshtein.

Read extra science and tech news:

How chaos unfolded at OpenAI

Heart of Milky Way captured for first time

UK to build new satellite to monitor climate change

Avoid purchasing on public networks

Black Friday promotions will usually attempt to entice you with restricted time offers, alerting you to them through an app notification, textual content message or electronic mail.

If one arrives when you’re out and about, it might be tempting to leap straight to it.

But purchasing on public wi-fi networks, like these you may discover at railway stations and on trains, is a nasty thought, in accordance with Mr Bluvshtein.

“Public wi-fi rarely has safety protocols such as passwords in place, and hackers can piggyback and steal unsecured banking details and sensitive information without you knowing,” he says.

What to do in case you suspect you have been scammed

Even with the very best will on the planet, there might come a second the place you observed the worst.

But attempt to not fret – there are steps you possibly can take to restrict the harm, or stop any from occurring in any respect.

“Keep an eye on bank accounts and if you see anything unusual, get in touch with them,” says Mr McLellan.

“Banks have got very robust fraud controls these days – and that’s why it’s best to use credit cards if possible.

“If you assume any of your on-line accounts have been compromised, change the password, and check out to not reuse them throughout totally different retailers.

“We do recognise that some of these have a technical bar to them, but if nothing else, at least keep an eye on what’s happening and be vigilant about your online activity.”